Housing markets across the country have stalled since mortgage rates began to rise in 2022, but relief may be on the way.

That’s according to Lawrence Yun, chief economist for the National Association of Realtors (NAR), whose latest forecast calls for a 9% increase in home sales in 2025 and a further boost of 13% in 2026. Underpinning these numbers are Yun’s belief that broader macroeconomic trends will boost the housing market.

Yun’s comments came at the annual NAR NXT conference in Boston, during which he noted the benefits of homeownership.

“When more people work, they have the capacity or they’re in a better position to buy a home,” Yun said. “Home sales depend mainly on jobs and mortgage rates.”

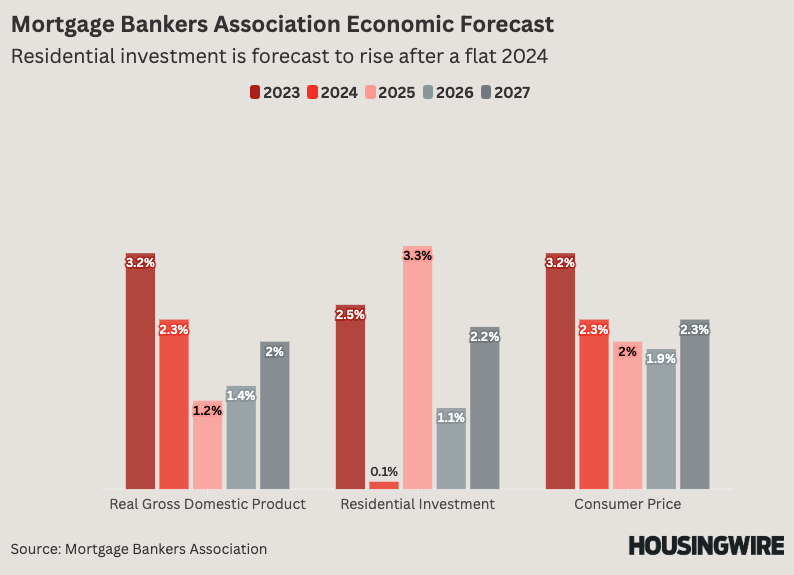

Yun’s forecast comes at the same that the Mortgage Bankers Association (MBA) released a macroeconomic forecast that predicts a sluggish economy over the next few years. While gross domestic product rose 3.2% in 2023, MBA’s outlook is that 2024 will finish at 2.3%, followed by three years of growth of 2% or less.

Residential investment — which boomed in the years following the COVID-19 pandemic — will be more mixed after hitting 2.5% growth in 2023. The MBA forecast shows a 0.1% gain in 2024, followed by more volatile growth of 1.1% to 3.3% in the next three years.

It also shows stabilizing inflation, with consumer price appreciation pinging between 1.9% and 2.3% per year. Mortgage rates will play a huge part in where the housing market goes from here, and Yun expects four separate rate cuts in 2025.

The elephant in the room for any current economic forecast is incoming President-elect Donald Trump, who has criticized Federal Reserve Chair Jerome Powell for his interest rate policies and has signaled his preference for rates to come down.

But Trump’s proposed plan for tariffs has been widely panned by economists, who say they would supercharge inflation. While specific numbers have varied on any given day, Trump proposed a 10% to 20% blanket tariff on all foreign imports and a 60% to 100% tariff on Chinese goods. In the days leading up to the election, he suggested a 25% tariff on Mexican imports.

If Trump implements these tariffs and they have the effects feared by economists, it would squeeze household budgets and make it more difficult for people to afford to buy a house, depending on whether the inflation would be offset by mortgage rate reductions. They would also push up homebuilding costs.

“Today, we have a massive budget deficit at a time when we are not in an economic recession,” Yun said at NAR NXT. “Clearly, President-elect Trump will not stop tax cuts; he will extend or expand them. There will be less mortgage money available because the government is borrowing so much money. However, if the Trump administration can lay out a credible plan to reduce the budget deficit, then mortgage rates can move downward.”